Searching for:

Search results: 116 of 1188

Blog | Thursday October 31, 2024

Racing Past the Crossroads: How Sustainability Leaders Can Reassert Ambition

Learn seven ways for sustainability leaders to reassert their commitment in transforming companies, economies, and societies

Blog | Thursday October 31, 2024

Racing Past the Crossroads: How Sustainability Leaders Can Reassert Ambition

Preview

BSR’s recent report, The CSO at a Crossroads: Three Paths Forward for Sustainability Leaders, drew on interviews with more than 30 chief sustainability officers (CSOs) to argue that we are at a crucial moment to reassert an ambitious vision for the CSO role.

After a period where CSOs focused (understandably) on reactivity and regulation, it is time to recognize the urgency and scale of global challenges and their implications for business. We emphasized the unique capabilities of the CSO in helping the company navigate external global developments and stakeholder interests with an eye on strategy, risks, and opportunities.

So how can CSOs steer down the more ambitious paths for sustainability leadership?

Here are seven ways sustainability leaders can reassert ambition in transforming companies, economies, and societies:

- Use futures, foresight, and scenarios to reframe the time horizon for ambition. Corporate approaches that emphasize reactivity and compliance are doomed to deliver incremental improvements and miss the long-term changes that affect business and society. Companies can recognize the benefits of more resilient and ambitious strategies by weighing, “What developments might shape our business and operating environment over the next 10 years, and what actions should we take to prepare for them?” BSR’s 2018 report, Doing Business in 2030, encouraged leaders to contemplate scenarios based on the hyper-politicization of business and sustainability, dramatic geopolitical fragmentation, breakthroughs in AI, and a global public health crisis. The 2024 report, Between Two Worlds: Sustainable Business in the Turbulent Transition, updates futures thinking to enable Boards and senior executives to focus on longer-term considerations.

- Focus on the top few areas with the most strategic importance and impact. To date, sustainability strategy has too often been an exercise in breadth and bundling—covering a range of topics and aggregating them into themes. This may have made sense in an era when companies were in the early stages of understanding their impacts. With foundational double materiality assessments in place, CSOs can pursue more ambitious impact agendas by identifying and investing in a select few strategic priorities. These priorities will need to be tailored for each company and may be linked to the specific business model (US private sector on EU regulations). As Robert G. Eccles and BSR alumna Alison Taylor noted, “The CSO role is finally becoming strategic, if you define strategy as the art of choosing what not to do. Today, CSOs help identify and direct attention to the ESG issues that have a substantial impact on an organization’s financial performance and risk profile. This approach aligns with broader corporate strategy-making, as it helps organizations focus on what matters most to long-term value creation.”

- Shift from disclosure to strategy; from assessment to action. Recent regulations have launched a scramble to strengthen corporate governance, risk assessments, and disclosures on sustainability. Those are worthwhile developments, but ultimately meaningless unless they serve as the basis for strategy, action, and impact. Companies that are investing so much now in due diligence and compliance should begin to focus more on the resulting actions that will yield meaningful improvements in real world risk, opportunities, and impacts. You can’t simply “CSRD away” your climate risk. A focus on collective action and collaboration within and across sectors can also avoid duplication and better align efforts towards more efficient and impactful change.

- Rethink business models to address the fundamental tensions among corporate interests, society, and the environment. Business and economic models based on indefinite growth and unmanaged externalities are already running up against environmental, social, and political limits. Those limits will threaten many companies, such as those that depend on cheap natural resources, endless disposable plastics, unfettered trade, fragile logistics networks, low wage labor, and use of personal data. These limitations may manifest in response to commitments and regulations. For example, incremental action against a context of ongoing growth will not suffice to help most companies achieve their public, investor-facing commitments to Net Zero and Science-Based Targets. Additionally, the European Sustainability Reporting Standards specifically call for disclosures to account for the impacts of a company’s business model. Moreover, companies have an opportunity to build more ambitious, resilient strategies by examining and innovating in how they create, deliver, and capture value amid changing environmental and social dynamics. Areas for exploration might include designing products/services for sustainability and human rights, development of circular or service-based business models, expanded employee ownership, and more inclusive governance models. Focusing on business models puts sustainability at the center of major business decisions—where to build a factory, which technologies to adopt, mergers and acquisitions. Boards and executives will have to make such business decisions within the wider societal context.

- Activate boards and executives. Corporate leaders have moved rapidly up the maturity curve on sustainability, particularly in their oversight of disclosures and compliance. It will be vital to shift boards and executives to more active roles in grappling with the strategic impacts, risks, and opportunities of sustainability.

- Elevate expertise and stakeholder voices. Senior executives and board directors rarely bring specific expertise in areas of vital sustainability importance such as climate change, human rights, and responsible AI. They also rarely come from vulnerable stakeholder groups. Important efforts are underway to upskill and diversify corporate leaders, though we can’t expect solutions to be quick or comprehensive. To access expertise, navigate complexity, and incorporate more diverse stakeholder viewpoints, boards and executives will benefit from ongoing platforms to tap external views. That might come through building partnerships, establishing external advisory councils, or leveraging industry wide stakeholder engagement. It might also include more significant governance changes such as mechanisms for employees to serve on boards, or granting a board seat to nature.

- Engage in public policy; strengthen geopolitical capabilities. The call for companies to engage more thoughtfully in public policy is not new, but it is more important than ever given political backlash and reluctance to take on the major challenges that social and environmental risks pose to economic and societal well-being, and the fracturing of global cooperation on issues like climate change, trade, and peace. Companies will benefit from aligning sustainability and public affairs to promote shared priorities and boost credibility. More importantly, they can enhance sustainable business leadership by using that base of credibility to encourage rational policies that manage systemic risks and promote positive, sustainable transformation in the business operating environment. While business associations have often focused on preventing regulation and tax policy, those associations could be valuable forums to amplify the collective voice of specific industries to advocate for a strengthened enabling environment for sustainable business.

BSR plans to use these preliminary ideas as a starting point to engage members in the coming months, and we welcome your solutions, critiques, and quandaries.

It is especially crucial that these conversations reflect the challenging context of the present and the global imperatives of the future. If CSOs are indeed at a crossroads, it is time to race along a path of integration, ambition, and transformation. We look forward to bringing together CSOs, CEOs, and Board Directors to further discuss the evolving role of sustainability leadership.

Blog | Wednesday October 30, 2024

Adequate Wages vs. Living Wages: Implementation Guidance for Companies

Unpack the differences in wage terminology, explore practical guidance on how companies can determine the Adequate Wage for a location, and learn what companies can expect to come from reporting and human rights due diligence requirements.

Blog | Wednesday October 30, 2024

Adequate Wages vs. Living Wages: Implementation Guidance for Companies

Preview

The term “Adequate Wage” has emerged across several EU legislations and the International Labour Organization’s (ILO) first ever guidance on Living Wage. As employers navigate complex regulatory environments, we have seen widespread confusion on how Adequate Wage compares to Living Wage and Minimum Wage.

Latest Developments

The recent advancements to drive improved wages both in the EU and globally include:

- ILO Position on Living Wage: The ILO came out with an official definition for Living Wage and published principles that data providers can follow. It is the first ILO framework to guide data providers and employers on Living Wages.

- EU Directive on Adequate Minimum Wages: A 2022 directive that requires EU countries to increase their Minimum Wages to align with “Adequate Minimum Wages.” This is defined as a 'double decency threshold' in which no Minimum Wage should be set below 60 percent of a country’s median wage and 50 percent of the gross average wage. Minimum Wages of EU member states that are below this threshold are expected to increase.

- EU Pay Transparency Directive’s (EU-PTD) Focus on Gender: To align with the EU-PTD by April 2026, companies must conduct gender pay assessments using specific standards, remediate those impacted by identified gender pay gaps, and publish the results of the gap analysis for the public.

- Corporate Sustainability Reporting Directive’s (CSRD) use of Adequate Wage: In order to comply with CSRD’s requirements, companies should work toward collecting, analyzing, and reporting data that address any Adequate Wage gap.

- The Corporate Sustainability Due Diligence Directive (CSDDD): CSDDD requires companies to evaluate and adapt their business plans, strategies, and operations, including purchasing practices, to ensure that they contribute to “Living Wages and incomes for suppliers and employed workers.”

How does Adequate Wage relate to Living Wage, Minimum Wage, Average Wage, and Collective Bargaining?

Minimum Wages are the lowest wage allowed by law. Collective bargaining agreements, driven by unions, also can shape wage rates for a particular industry or job position in a country. Many people question why evaluating Living Wages is necessary when the concept of a Minimum Wage was originally intended to reflect the wage rate required for a worker and their family to live a decent life.

In practice, Minimum Wages are shaped by governments, meaning that the level and frequency at which they are increased to align with costs of living varies, and is often insufficient. Similarly, collective bargaining agreements only exist with strong working unions. Beyond legally compliant wage obligations, compensation teams pay close attention to average wages that reflect labor market conditions. A Living Wage, on the other hand, is based on cost-of-living, and is not shaped by politics, negotiation, or economics conditions.

The concept of Adequate Wage aims to take into account the different roles each of these wage rates play. According to ILO, an Adequate (Living) Wage is “a wage that meets the needs of a worker and their family, taking into account the national economic and social conditions of a country.” While the implementation of Adequate Wages at the country level is still underway, this guidance will aim to inform companies on how to measure Adequate Wages to prepare for CSRD requirements.

How can companies prepare to meet Adequate Wages in the coming years?

The CSRD explains that companies must “disclose whether or not its employees are paid an Adequate Wage.” Companies should start by evaluating if Minimum Wages are paid. This is an important first step, but due to the fact that in some countries a Minimum Wage may not be enough to cover the needs of a worker and their family, a secondary level of analysis is required to determine if the Minimum Wage is an Adequate Wage by looking at Living Wage benchmarks and the double decency threshold.

Understanding the Adequate Wage for a country or region is dependent on each location’s context, in order for companies to close any pay gaps to meet regulations like the CSRD, companies will need to conduct a gap analysis for Minimum Wage, Adequate Wages and Living Wages.

In many cases, Minimum Wages may be sufficient for reporting. Nevertheless, it is important to compare it to Living Wages and the double decency threshold to anticipate where Minimum Wages will likely be increasing. According to WageIndicator’s Adequate Wage Guide, the Adequate Wage is determined by whichever figure is highest. Follow these steps to start your gap analysis:

- Step 1: Check the Statutory Minimum Wage as applicable in the country, sector, industry, region, age-level etc. The Minimum Wage is the law and the minimum threshold.

- Step 2: In countries where there is no Statutory Minimum Wage, where applicable and possible, check the lowest negotiated wages as stipulated in Collective Agreements for your sector, industry, or company.

- Step 3: Check the ‘double decency threshold’ for a country (50 percent of the average wage and 60 percent of the medium wage) as well as the Living Wage estimates for a country and region. In cases where the Living Wage estimates are highest, use those.

- Step 4: If the ‘double decency threshold’ exceeds the Living Wage estimate, consider the Adequate Wage, but first verify regional Living Wage variations.

- Step 5: The CSRD requires companies to report on an “Adequate Wage.” Depending on the country, this could be the Statutory Minimum Wage, a collective bargained wage, an Adequate Wage, or a Living Wage estimate.

How BSR can help

BSR has worked with dozens of companies for twenty years to conduct Living Wage gap analyses and advance their Living Wage programs. For more information on BSR’s services on Living Wage, please contact us.

Blog | Thursday October 24, 2024

Collaboration Crossroads: Recognizing When to Part Ways for Greater Impact

What are the signs that a collaborative initiative is reaching the end of its tenure and how can businesses tell whether the “red flags” being seen are conquerable hurdles or warning signs of a pending end?

Blog | Thursday October 24, 2024

Collaboration Crossroads: Recognizing When to Part Ways for Greater Impact

Preview

Business-led, pre-competitive collaborative initiatives are a cornerstone of systems change and advancing solutions to systematic problems. They allow companies to enter a safe space for best practice sharing, pool resources for problems that any single company could not solve alone, and use a collective voice or action to drive system change across entire industries. However, collaborations are not meant to be everlasting, and companies must recognize when it’s time to pull the plug.

When collaborations begin to flounder, resources become constrained, participants become weary, and impact is minimal. Many of the “red flags” participants might see in collaborations can be conquerable hurdles, or they can be warning signs of a pending end. It is important to be able to read the tea leaves, know the difference, and evolve accordingly or plan for an ending.

There are a few clear signs that it may be time for a collaboration to consider sunsetting.

1) Collective goals achieved

The first and most obvious sign that a collaboration should close down is when the intended impact or goal is achieved. Collaborations form around collective visions for learning or creating change. A common mistake is passing that point and trying to refresh a strategy for new goals. While a natural next milestone may arise out of the existing work, trying to carve out a new strategy with the existing members and governance structures may create more challenges and conflict than necessary. Rather than continue, consider which aspects could be spun into a separate, tangential project. BSR’s Future of Fuels is a success story of companies that achieved their mission and goals and sunset the collaboration.

2) Insurmountable barriers

Collaboratives typically form when companies come together to solve some of the world’s most difficult challenges. If they were easy problems to solve, it wouldn’t need a group of companies to find the solution. It is quite common for collaborations to refresh a strategy, change direction, and realign. However, acknowledging when hurdles become blockades is an important trait among participants. Occasionally, we may enter a space before the technology is scalable, before policy allows progress, or there’s a learning curve that sheds light on needs for impossible resourcing. Any number of barriers may pop up, but knowing when they prevent progress and impact will be a telltale sign that a collaboration may not succeed.

3) Dwindling participation or absence of enthusiasm

Nearly every collaboration seeking high-impact or systems change thrives on members’ participation and passion. Individuals may become less interested in topics, turnover in a company might introduce a disinterested or uninformed replacement, company priorities might shift, or the external ecosystem evolves. Any of these factors may influence the participation of members and therefore the progress of the group. This is another “red flag” that may be a temporary challenge, or it may be a sign of greater trouble ahead. Any collaboration that begins to lose its value proposition to members cannot survive. When participants pull back, it is an important reminder to see the bigger picture, reevaluate the problem, rethink aspects like relationships or governance, and determine if there is a possible impact to be made by the group before deciding to sunset.

4) Misalignment among members

It is often a single challenge that brings members together, but it is the individual goals of each participant that keep them in the room. When companies begin diverging from the original goal, it may be due to their own shifting priorities and nothing to do with the collaboration, but it will almost certainly drive a wedge in the collaboration. These situations are fairly common, but when a fracture cannot be repaired and the dissonance is too great, it is important to recognize that it is no longer a collaborative effort for a singular goal. It is natural for priorities and objectives to shift throughout a collaborative lifecycle; however, when members can no longer align on collective objectives, and it is likely more resource-intensive to redirect the group, it may be time to acknowledge the successes and end the collaboration.

Collaboration can be a powerful tool that brings companies together in hopes of solving the world’s most challenging problems. It can also be one of the most difficult, emotionally tolling, and disappointing tools when it falters or fails. Preventing collaboration fatigue and distrust in collaborative efforts often falls on those in the room to know when it is time to sunset. It is rarely black and white, but recognizing the signs and creating a candid space for honest conversations can help tease out the potential impacts and reinvigorate the group. It can also help bring closure when the time comes to shut the doors.

As collaboration experts focused on making an impact, BSR recognizes the difficulties, but also the power, of collective action. The end is inevitable to make room for new beginnings, ideas, and people. The sunset of a collaboration is never truly the end, but rather an opening to start over or for new solutions that can change the world.

Reports | Thursday October 17, 2024

The CSO at a Crossroads: Three Paths Forward for Sustainability Leaders

BSR interviewed 31 CSOs to hear their perspectives on their evolving role, understand current challenges, and how they ensure that sustainability remains a priority at the highest levels of corporate decision-making.

Reports | Thursday October 17, 2024

The CSO at a Crossroads: Three Paths Forward for Sustainability Leaders

Preview

The role of the Chief Sustainability Officer (CSO) is evolving in dramatic ways. What began as an entrepreneurial role has now developed into a professional, fully integrated function embedded within corporate governance, compliance, and accountability.

While more visible and valued than ever before, heightened expectations and pressures are placing the CSO at risk of becoming overly focused on compliance at the expense of innovation and strategic foresight.

Amidst a backdrop of rapid changes in the landscape, BSR interviewed 31 CSOs to hear their perspectives on this dichotomy, understand current challenges, and how they ensure that sustainability remains a priority at the highest levels of corporate decision-making.

Inside the Mind of the CSO

How are CSOs feeling about these changes? Some feel invigorated to finally have the level of integration they have sought for years; others feel dismayed, stuck, or even bored at the lack of progress. Among the 31 CSOs interviewed by BSR, key findings include:

64 percent of respondents feel that regulation enables meaningful strategic impact.

83 percent of respondents feel that increased involvement by other C-Suite executives helps advance ambitious sustainability objectives.

Only 50 percent of respondents spend 70 percent or more of their time on "high-impact" work.

A Crossroads and Three Paths Ahead

CSOs are at a pivotal moment—facing more opportunity, relevance, visibility, and pressure than ever before. The report traces the evolving role, and proposes three potential paths ahead:

Reports | Tuesday October 15, 2024

Stakeholder Engagement in the Transition Context: Guidance for Practitioners

When navigating the transition to a low-carbon economy, it is vital that businesses engage proactively with stakeholders. BSR’s Energy for a Just Transition highlights key considerations for conducting stakeholder engagement within the context of a just transition.

Reports | Tuesday October 15, 2024

Stakeholder Engagement in the Transition Context: Guidance for Practitioners

Preview

Stakeholder engagement in the oil, gas, and energy sectors has evolved significantly over the decades. While many companies are currently using well-developed stakeholder engagement methods, the context of a just transition introduces new challenges and opportunities. By acknowledging existing strengths in stakeholder engagement while innovating to address gaps in current approaches, companies can help foster more equitable, inclusive, just, and sustainable engagement with all stakeholders throughout the transition process.

As businesses navigate the transition to a low-carbon economy, it is vital that they engage proactively with stakeholders to understand their perspectives and concerns before making major decisions that impact them. In this report, BSR’s Energy for a Just Transition Collaborative Initiative highlights key considerations and processes for conducting stakeholder engagement within the context of a just transition.

Blog | Thursday October 10, 2024

An Impact-Based Approach to Responsible AI

Discover five key considerations for sustainability teams to understand, manage, and report on social and environmental issues as they learn to navigate AI’s evolving landscape responsibly.

Blog | Thursday October 10, 2024

An Impact-Based Approach to Responsible AI

Preview

Businesses are racing to integrate artificial intelligence (AI) technologies into their operations, spurred by the skyrocketing investment in generative AI, which reached US$25.2 billion by the end of 2023. Studies show that AI has the potential to improve productivity and enhances work quality by enabling employees to complete tasks more efficiently and bridging the skill gap between low- and high-skilled workers leading to reduced costs and increased revenues.

While many companies have adopted “Responsible AI” concepts—such as a focus on AI principles and governance, liability reduction, and avoidance of immediate risks—these approaches are insufficient to manage the profound impacts, risks, and opportunities posed by AI.

The development and use of AI technologies can bring environmental and societal risks related to the electricity grid and water supply, the right to privacy and worker rights, and beyond. Responsible AI efforts are often not well integrated with the core work of sustainability teams in understanding, managing, and reporting on such social and environmental issues.

BSR believes that a responsible approach to AI considers the potential benefits and adverse impacts of AI on people and the environment across the company’s value chain over the short, medium, and long term.

Rather than a focus on proximate liabilities and compliance, this approach focuses on understanding impacts as a way to identify and manage future risks. It also aligns with corporate sustainability regulations (e.g., the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD)) and business and human rights standards (e.g., UNGPs, OECD Guidelines). An impact-based approach can also help companies comply with the EU AI Act, as the act requires companies to identify and address the impacts of AI on fundamental rights.

While business leaders recognize the risks associated with AI, companies are largely unprepared to address them. According to Gartner, 66 percent of executives see the mass availability of AI as an emergent risk, but only 11 percent feel confident about their ability to provide effective oversight on AI risks. This points to a significant gap in current company practices.

BSR recommends five key considerations to effectively manage the social and environmental impacts of AI:

1) Social and environmental impacts are at the core of AI risks and opportunities. Common company practices for Responsible AI include AI principles, policies, compliance, and avoidance of legal risk. The actual and potential impacts of AI on people and the environment are often under-explored by companies. These impacts can be the main drivers of corporate risks and opportunities; addressing them is essential to build a meaningful approach to Responsible AI.

What are the social and environmental impacts of AI? Here are some illustrative examples.

Impacts to People:

- Bias in AI models leading to the discrimination of underrepresented groups

- Violations of the right to privacy

- Implications on employment, labor markets, democracy, and information systems

- Precarious working conditions for AI data enrichment workers

Impacts to the Environment:

- Increased energy consumption and carbon emissions for training and running AI models

- Downstream environmental impacts with the use of AI for harmful use cases (e.g., AI use to speed up fossil fuel extraction or to increase consumption of non-sustainable products)

- Increased water use and land conversion for datacenters

- Increased pollution and e-waste for manufacturing semiconductors and hardware that power AI models

2) Sustainability teams bring valuable tools to Responsible AI. Responsible AI practices are often led by cross-functional groups including data science, privacy, and compliance/legal teams. Sustainability teams can bring significant value to this work by coordinating with existing initiatives to understand the company’s environmental and social impacts, risks, and opportunities. Sustainability leads can also leverage existing toolkits for addressing these impacts, such as materiality assessments, human rights assessments, stakeholder engagement practices, and sustainability reporting.

Embedding AI-related impacts into existing sustainability structures and processes can make it easier for companies to manage both these fast-moving risk areas. Furthermore, leveraging the synergies between sustainability and AI can help create long-term business value.

3) Risks lie throughout the full AI value chain. Often when we think of AI impacts, we think of downstream impacts related to the use of AI, such as job displacement, bias and discrimination, surveillance, or misinformation. However, social and environmental impacts also occur in the upstream AI supply chain, such as worker rights issues related to data enrichment service providers, or increased water use and land conversion for datacenters that power AI systems. All these impacts should be considered as part of Responsible AI efforts. Importantly, sustainability regulations such as the CSRD and CSDDD require companies to conduct due diligence on and disclose impacts across their full value chain.

4) AI activities and risks differ by business function. AI-related impacts can occur across different functions depending on the company’s business model and AI use cases. Companies examining AI often focus on IT and engineering, but AI-enabled solutions are being used by a variety of different teams, including human resources, marketing, sales, and customer service. Increasingly, boards and executive teams are also using AI-based solutions to support corporate decision making. Engineering and procurement teams are two key functions where Responsible AI measures should be integrated when developing or purchasing AI solutions; but impacts can occur anywhere in the company.

Below we provide examples of AI use cases and illustrative impacts across different business functions, which can all lead to sustainability and business risks.

5) AI use will have impacts in the short, medium, and long-term. Often, we focus on short-term impacts; however, AI technologies may also have impacts in the longer term. For example, impacts on labor and the economy, or impacts on democracy and information systems. Note that sustainability regulations such as the CSRD require companies to disclose impacts across the short, medium, and long-term.

Similarly, some of the long-term impacts are not related to individual companies. They are cumulative impacts of the use of AI across industries. It is important for companies to take collaborative approaches to explore and address these cumulative long-term impacts.

As AI transforms industries, adopting a responsible approach is critical to harnessing its potential while managing its risks. By considering AI’s impacts on people and the environment throughout their value chain, businesses can position themselves for long-term success.

To learn more about how BSR helps companies adopt an impact-based approach to Responsible AI, and to discuss what’s right for your organization, please reach out to us at web@bsr.org.

Blog | Thursday October 3, 2024

Sustainability Strategy in the Age of Regulation: Don’t Lose the Plot

Explore three key areas business leaders can focus on to effectively navigate the complex intersection between corporate strategy, regulatory obligations, and stakeholder expectations.

Blog | Thursday October 3, 2024

Sustainability Strategy in the Age of Regulation: Don’t Lose the Plot

Preview

The sustainability landscape is rapidly evolving, driven in part by landmark legislation like the Corporate Sustainability Due Diligence Directive (CSDDD), among others. Regulation acts as a forcing mechanism, raising the floor for action on sustainability across companies by compelling businesses to use rigorous, best-practice methodologies to identify, act on, and disclose numerous topics and data points. This is a good thing. But it brings new compliance risks associated with undertaking historically voluntary activities in a regulatory context and driving limited resources toward those activities (and often away from other priorities).

Business leaders can focus on three key areas to effectively navigate the complex intersection between corporate strategy, regulatory obligations, and stakeholder expectations: pragmatic compliance risk management, careful prioritization, and proactive opportunity identification.

1. Take a pragmatic approach to compliance

While BSR does not provide legal advice, it is safe to say that there are new and heightened risks associated with selectively disclosing and acting on certain sustainability issues while deprioritizing others. Companies are exposed to scrutiny, fines, and potential litigation related to the due diligence they conduct, the thresholds they set, and the accuracy of the information they present. Adding complexity: these regulations are new, they vary in scope and ambition by jurisdiction, and our collective understanding of what constitutes a reasonable effort or “good judgment”, let alone leading practice, is still emerging.

Expert judgement is critical in right-sizing your approach today and continuously improving practices over time. Effective balance of compliance and strategic risk requires stronger collaboration between functions and engagement with relevant external advisors. Companies must leverage the expertise of sustainability professionals with direct experience overseeing sustainability strategies and implementing the prior voluntary standards alongside newly engaged accounting and legal professionals to understand what is right for them. For example, sustainability teams and audit/risk/compliance teams should work closely together to make sure that they deploy consistent evaluation criteria and have a unified understanding of an issue, as they address the compliance and the impact element of the same topic. They can also work together to determine the amount of data that is sufficient to underpin judgments today and how to lay the groundwork for what will be needed over time. Robust governance is essential to support this cross-functional collaboration and ensure that appropriate expertise is adequately represented in decision-making.

In addition, companies must ensure that the relationship between existing sustainability strategy and relevant regulatory requirements is clear and easily understood. Where possible, it is important to reference sustainability terminology, definitions, KPIs, and metrics from the standards rather than creating your own.

2. Carefully prioritize what to do with limited resources

Not all topics warrant the same level of attention. There is a risk that excessive focus on collecting and reporting information on non-strategic issues (both from an impact and financial perspective) may divert attention and resources from key strategic priorities. If too many things are material, it can be difficult to act with purpose.

So, how can companies effectively determine material topics for disclosure, prioritize impacts for mitigation and choose focus areas for long-term strategy? BSR recommends a methodical approach that pairs the regulatory requirements with good business sense. Meaningfully aligning with the spirit and the letter of these regulations can help companies prioritize their resources on issues that are core to how companies do business, providing a foundation for building business resilience and achieving impact.

Many factors contribute to strategic prioritization, some but not all of which are explicitly driven by mandatory requirements. Financial and impact materiality assessments, human rights salience and impact assessments, climate and nature assessments, and risk and scenario analysis all have a role to play in determining strategic priorities. So too does a deep understanding of a company’s business model, key points of leverage, and financial positioning. As a first step, harmonizing methodologies across various assessments (e.g., establishing uniform criteria for assessing similar impacts or establishing a unified stakeholder engagement strategy) ensures that compliance needs are met and well-established sustainability frameworks inform strategic decision-making.

It is also critically important to take a step back and examine the intersections between topics. While the regulatory frameworks encourage companies to break down information into highly granular detail, thoughtful aggregation of key insights to identify cross-cutting solutions provides the greatest strategic value. For example, a focused initiative to reduce single-use plastics might spark innovative business opportunities with financial and operational benefits as well as benefits to the environment up and downstream. Careful consideration of these intersection points will help to pinpoint a handful of realistic and highly impactful initiatives for a company to rally around rather than a laundry list of disparate actions lacking sufficient attention.

3. Don’t forget about the opportunities

While regulations like the CSRD call for the identification and disclosure of impacts, risks, and opportunities, in practice many compliance-focused efforts are predominantly concerned with negative impacts and business risks associated with business as usual. Nevertheless, opportunities for innovation remain a critical element of strategy. New models, products, and services that can address broader societal challenges like the energy transition or healthcare for underserved populations are desperately needed, and identifying and addressing critical needs is where businesses have an opportunity to shine.

To start, companies can set themselves up for success by looking for ways to surface opportunities across stakeholder engagement opportunities and assessment work, including where appropriate in environmental and social due diligence (e.g., human rights impact assessments) and reporting.

The regulatory frameworks provide guardrails for how companies act on sustainability but do not go so far as to prescribe a company’s ambition, nor specific performance targets. Realizing potential opportunities therefore requires relevant teams (e.g., sustainability, product innovation, marketing) to proactively explore the future operating environment and have a mandate to pursue objectives beyond minimum compliance, sometimes with more uncertain or longer-term benefits. Trends assessment and scenario planning can be useful complements to backward looking analytical tools. Embedding sustainability considerations in regular interactions with external stakeholders and in decision-making tools (e.g., product innovation check lists) can help to ensure opportunities are surfaced in real time, when they are most strategically relevant and decision useful.

The rise in mandatory requirements presents both challenges and opportunities for businesses. By pragmatically managing compliance risks, carefully prioritizing objectives, and proactively embracing sustainability-related opportunities, companies can successfully navigate this intersection and drive meaningful progress toward a more sustainable future.

BSR’s multidisciplinary team takes a comprehensive approach to sustainability strategy and regulatory compliance, helping companies to develop customized approaches that are right for their unique circumstances. If you’d like further information, and to discuss what’s right for your organization, please don’t hesitate to reach out to us.

Audio | Tuesday October 1, 2024

Reflections from Climate Week NYC: The Tension Between Pragmatism and Ambition

Immediately following Climate Week NYC, BSR President and CEO Aron Cramer chats with David Stearns about some of the inconvenient truths facing sustainability leaders going into this annual gathering, observations that gave him cause for optimism, and a look inside some of BSR’s events, including a debate over whether American…

Audio | Tuesday October 1, 2024

Reflections from Climate Week NYC: The Tension Between Pragmatism and Ambition

Preview

Immediately following Climate Week NYC, BSR President and CEO Aron Cramer chats with David Stearns about some of the inconvenient truths facing sustainability leaders going into this annual gathering, observations that gave him cause for optimism, and a look inside some of BSR’s events, including a debate over whether American political leadership is needed for advancing global climate action and shaping climate policies. Aron also highlights two new BSR publications featuring guidance for sustainability leaders on navigating these turbulent times, and new insights from over 30 Chief Sustainability Officers of BSR member companies.

Blog | Tuesday September 24, 2024

Is Your Company Ready for TNFD?

Assessing readiness for nature disclosure helps identify gaps and priority actions in understanding and acting on your company’s nature-related risks.

Blog | Tuesday September 24, 2024

Is Your Company Ready for TNFD?

Preview

Nature disclosure has become the new norm for companies, due to both regulation and stakeholder pressure. Mandatory disclosure is now here, with companies around the world subject to the Corporate Sustainability Reporting Directive (CSRD) and its nature-related disclosures: ESRS E4-Biodiversity and Ecosystems, E3-Water and Marine Resources, E5-Resource Use and Circular Economy, and E2-Pollution. The EU’s Corporate Sustainability Due Diligence Directive (CSDDD) will also require companies to assess their impacts to the environment throughout the value chain.

At the same time, investors and stakeholders are increasingly expecting companies to disclose their nature-related impacts and risks. The new norm of corporate nature disclosure reflects the growing recognition of the financial and operational risks nature loss poses to companies and their supply chains, as well as companies’ roles in impacting and remediating impacts to biodiversity and ecosystems.

The Taskforce on Nature-Related Financial Disclosures (TNFD) is the principal framework for voluntary nature-related disclosure, representing a new pathway for companies and financial institutions to act on nature loss. TNFD is closely aligned with CSRD, and the TNFD LEAP approach—Locate, Evaluate, Assess, Prepare—supports companies in assessing their nature-related impacts, dependencies, risks and opportunities necessary for disclosing under both frameworks. Indeed, TNFD and LEAP are expressly mentioned throughout CSRD, so they represent a useful framework to support companies’ mandatory and voluntary disclosure.

Market trends suggest that TNFD uptake will mirror that of its climate cousin, the Task Force on Climate-Related Financial Disclosures (TCFD), but at a more rapid pace. More than 320 companies have already committed as “early adopters” to disclose under TNFD in the next two years, representing listed companies based in 46 developed and emerging economies. Nearly a third of early adopters (100 of the total 320) are financial institutions, including asset owners and managers, collectively representing US$14 trillion in assets under management.

While reporting on nature-related impacts, dependencies, risks, and opportunities may seem daunting, companies already have some data available to report. Companies already reporting under TCFD likely have or could easily incorporate nature into existing processes and data.

Limited data is not an excuse for inaction, since similar to the TCFD, the majority of the recommended disclosures focus on process descriptions that do not require quantitative metrics to start reporting. Indeed, many companies already have a significant amount of existing data available (e.g., ERM, nature-related policies, substances of concern procedures, secondary data sources such as LCA and climate data, etc.) to disclose under TNFD, so conducting a gap assessment can be a good first step in understanding your readiness to disclose and where further action is needed.

To support our members in disclosing under TNFD, BSR provides a TNFD Readiness Check service to assess if a company is prepared. Key steps include:

- Holding a TNFD learning session with relevant employees to establish a strong foundation for the assessment. The session provides an overview of how TNFD fits into the broader reporting landscape, including CSRD, Global Reporting Initiative (GRI), and Carbon Disclosure Project (CDP).

- Conducting a peer benchmark—specific to TNFD—to understand industry norms and trends, best practices, and insight into market positioning.

- Carrying out a gap assessment of company data against TNFD reporting requirements and summarizing both promising starting points and remaining gaps.

- Based on the results of the benchmark and gap assessment, developing strategic and tactical recommendations for approaching TNFD.

Overall, our support seeks to ensure companies have a solid understanding of TNFD and how it fits into the broader disclosure landscape, clarity on their readiness to disclose and the actions needed to close gaps, as well as overall insights on their priority actions and positioning within the market. While we also support companies on CSRD reporting, BSR’s TNFD support provides a rapid and nature-focused assessment of existing data to support companies on their nature journeys.

Please contact our Nature team to find out more and discuss how we might support your company’s TNFD disclosure. While what we share here outlines our standard approach, we are pleased to customize our approach to best fit your company’s needs, timeline, and budget.

Blog | Monday September 23, 2024

CSDDD: A De Facto Climate Due Diligence Law That Safeguards People

The CSDDD offers an opportunity to advance transformational climate action centered on just transition principles.

Blog | Monday September 23, 2024

CSDDD: A De Facto Climate Due Diligence Law That Safeguards People

Preview

The EU Corporate Sustainability Due Diligence Directive (CSDDD)’s Climate Transition Plan (CTP) requirement has three major implications for climate action:

- Delivering climate transition plans, including science-based targets covering Scope 1, 2, and 3 across the full value chain, are now a legal obligation.

- Climate transition plans are evolving from being seen merely as a reporting tool to a key strategic approach. The CSDDD requires companies to determine whether their business model and strategy are compatible with the 1.5°C goal of the Paris Agreement—taking corrective action if they are not.

- Climate transition plans should be grounded in respect for human rights to ensure climate actions are sustainable, just, and equitable. By requiring companies to conduct human rights due diligence on their negative impacts, CSDDD brings the just transition in scope—with potential litigation risks for non-compliance.

Climate Week NYC is upon us. Sustainability professionals are gathering in New York City for arguably the most important milestone in the climate agenda this year. With the climate crisis dangerously nearing tipping points, and this year marking halfway through the “decisive decade,” the CSDDD offers an opportunity to advance transformational climate action centered on just transition principles.

After years of negotiation, the EU’s CSDDD entered into force in July 2024. Arguably the EU’s most ambitious sustainability measure, companies in scope must adopt and implement Climate Transition Plans (CTPs) and conduct due diligence to assess and manage their negative human rights and environmental impacts.

Regulating Climate Action for Business

While governments have advanced a range of climate-related regulations, these measures have focused on disclosure, not action. CSDDD makes delivering the Paris Agreement a regulated affair for business—and that’s a big deal.

According to the CSDDD, companies must “adopt and put into effect a climate mitigation transition plan that aims to ensure, through best efforts, that their business model and strategy are compatible with the transition to a sustainable economy and with the limiting of global warming to 1.5 °C in line with the Paris Agreement.” This includes time-bound targets for 2030 and five-year steps up to 2050, including absolute targets for scopes 1, 2, and 3 (covering full value chain, unlike CSDDD’s other due diligence requirements).

CSDDD establishes CTPs as a strategy tool. It makes clear that reaching Paris Agreement goals requires companies to transform their business models, which includes addressing tensions between their growth and sustainability.

Advancing Climate Due Diligence

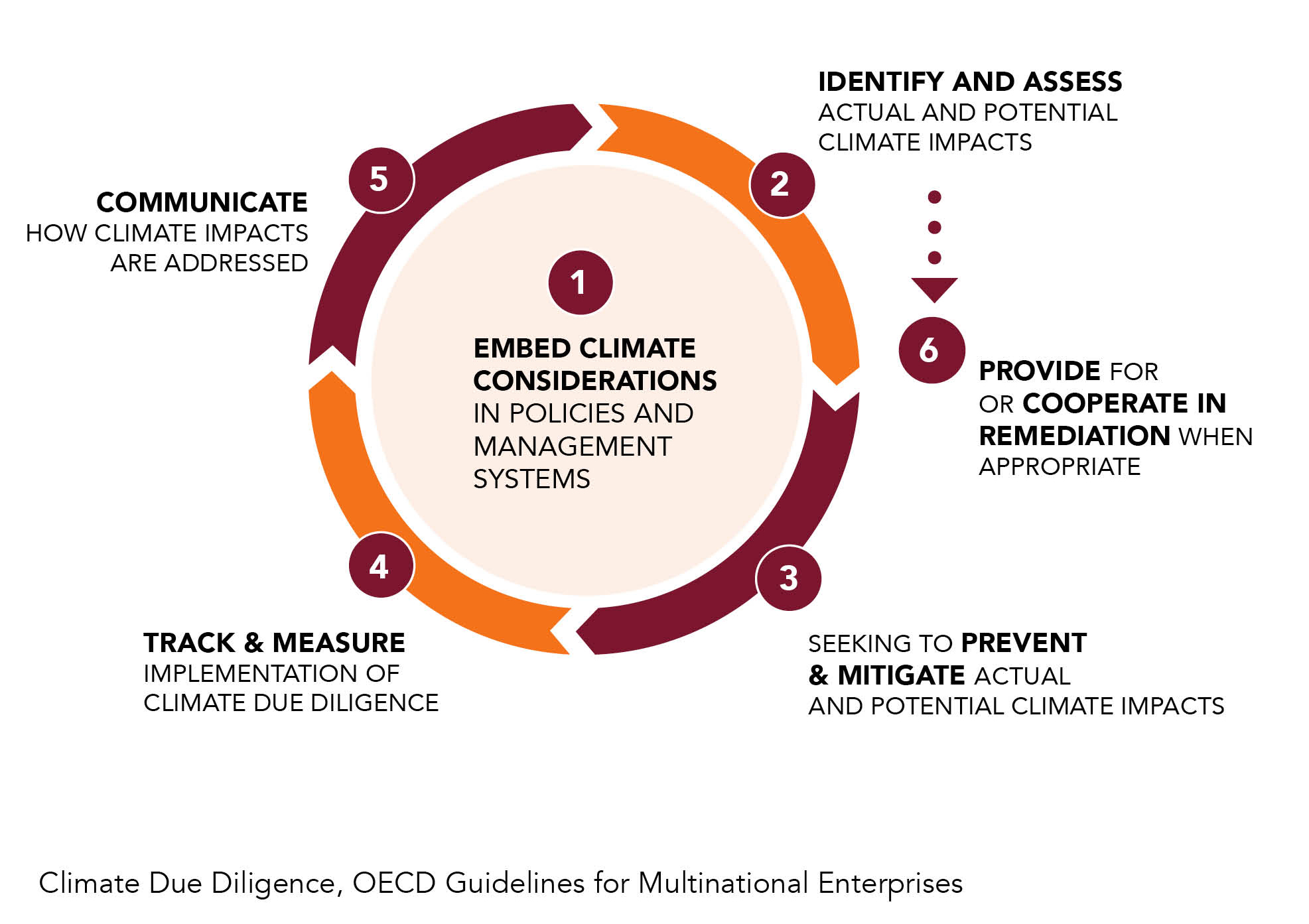

The CSDDD is grounded in global due diligence standards. The OECD Guidelines expect companies to conduct climate due diligence to assess and manage the adverse climate impacts they generate and to conduct human rights and environmental due diligence to address the negative impacts of their operations and value chains, including their climate activities, on people and nature.

Click on the image to view a larger size

Voluntary frameworks on climate action have long directed companies to align with steps of climate due diligence, such as identifying, mitigating, and communicating climate impacts. For instance, companies following Greenhouse Gas (GHG) Protocol, Science Based Targets Initiative (SBTi), Task Force on Climate-Related Financial Disclosures (TCFD) governance-related guidance, Carbon Disclosure Project (CDP) disclosure expectations, or frameworks such as Transition Plan Taskforce, are ahead on their CSDDD CTP-related compliance journey.

While CSDDD doesn’t require companies to assess their impacts on climate, companies must know their emissions to adopt and implement credible, CSDDD-aligned CTPs.

CSDDD is Closing the Just Transition Gap

Climate action is urgent, but it must be just and inclusive. Few climate transition frameworks (e.g., Glasgow Financial Alliance for Net Zero, or GFANZ, UK’s Transition Plan Taskforce) ask companies to assess the impacts of climate action on people—and none ask companies to address them. This perpetuates siloes between climate and human rights teams within companies.

At first glance, the CSDDD’s CTP requirements reflect a siloed approach. There is no explicit requirement to consider the actual or potential negative impacts of climate mitigation on people. CSDDD also doesn’t explicitly require companies to focus on adaptation—which is a miss. Yet by requiring companies to conduct human rights due diligence on the negative impacts of their operations, supply chains, and limited downstream partners, the just transition is in scope.

Respecting human rights in climate action involves committing to respect human rights in the transition out of fossil fuels and into a green economy. Companies must expand human rights due diligence to cover CTP measures, such as decommissioning mining sites, switching to renewables, and protecting carbon sinks, and enable remedy when harms occur.

Engagement of affected stakeholders, such as workers, trade unions, communities, and Indigenous Peoples, is required. This may take the form of tripartite dialogue with trade unions and government or engaging in good faith processes of free, prior, and informed consent. At all times, companies must provide comprehensive information about climate mitigation plans and activities that may affect people’s lives and ensure ongoing consultation while reducing engagement barriers and ensuring people are free from retaliation.

Companies that fail to comply with CSDDD’s due diligence requirements may be held civilly liable for any resulting damages to people. This comes amidst the rise of just transition litigation—affecting companies that extract and produce materials critical for the transition, as well as wind energy, hydropower, and solar projects—a trend that is certain to continue.

CSDDD Preparation: Putting Just Transition at the Heart of Climate Action

Few companies have conducted human rights due diligence of CTPs despite growing attention to just transition in GFANZ, the Transition Plan Taskforce (TPT), and the Corporate Sustainability Reporting Directive (CSRD). The following recommendations support an ambitious approach to preparing for CSDDD:

- Assess gaps in CTP mitigation measures and associated climate and human rights due diligence approaches against CSDDD requirements. Review business models to ensure compatibility with Paris Agreement goals and respect for human rights.

- Assess alignment of overall climate strategy with the OECD Guidelines and the UN Guiding Principles to strengthen a holistic approach to human rights and climate change. Ensure the climate approach focuses not only on mitigation, but on adaptation and climate justice.

- Engage and strengthen board and senior leadership capacity. Strong leadership is needed to set the tone and ensure the company leans into the complexities associated with adapting business models, evaluating trade-offs, and ensuring net-zero efforts are grounded in human rights due diligence.

- Build internal expertise and foster cross-functional collaboration between human rights and climate teams, including when conducting due diligence and designing strategies and action plans.

- Develop an affected stakeholder engagement strategy, including stakeholder mapping to identify all groups relevant to each mitigation activity, such as climate-vulnerable stakeholders. Create an engagement timeline that starts earlier than traditional project cycles and design culturally appropriate engagement methods for each group.

- Identify and scrutinize collective action platforms that support climate mitigation efforts. Use leverage within initiatives to promote the inclusion of human rights and just transition approaches in the transition to a Paris-Agreement aligned economy.

BSR will discuss the connection between environmental and human rights due diligence this week at Climate Week NYC.

Interested in advancing your company's Climate and Human Rights Due Diligence Strategies? Contact BSR’s Human Rights and Climate experts to find out more.