Authors

-

Managing Director, Business Transformation, BSR

-

Managing Director, Business Transformation, BSR

-

Sonia Teanio

Former Manager, Transformation, BSR

In the past decade, sustainability has moved from the glossy pages of corporate social responsibility brochures to the black-and-white disclosures of the 10k. With this increase in strategic importance, external scrutiny, and governance mandates, sustainability has become a crucial topic on the board agenda.

In light of these shifts, BSR and the National Association of Corporate Directors are proud to launch Oversight of Corporate Sustainability: A Board Primer. As BSR President and CEO Aron Cramer and NACD President and CEO Peter Gleason note in their forward to the report: “We hope that in combining our organizations’ resources, expertise, and reach we can jointly empower directors and transform boards to stay on the leading edge of corporate governance and efforts to build a just, sustainable, and thriving world.”

Understanding the Board’s Role in Sustainability Oversight

Boardroom focus on sustainability is essential for companies to anticipate and address profound and intertwined changes in the economy, society, and the environment that affect their businesses.

-

New technologies, such as artificial intelligence and advances in facial recognition, not only promise to unleash innovation but also hold the potential for massive economic disruption and impacts on human rights.

-

Geopolitical uncertainty and threats to democratic norms imperil global stability, freedom, and connectedness—along with the flow of trade, talent, and ideas.

-

A radically changing workforce and talent landscape shaped by a reinvigorated labor movement, new workplace technologies, and the changing expectations of rising generations.

-

Inequality continues to hold back human potential and harm individuals and communities.

-

The impacts of climate change are highly disruptive: 3.6 billion people are already living in areas highly susceptible to climate change, and it is estimated that the global cost of climate change will be between $1.7 and $3.1 trillion every year by 2050.

Each of these developments creates major risks and presents opportunities to the economy as a whole, to industries and value chains, and to individual companies.

The importance of these developments is also increasingly recognized by governments, regulators, investors, employees, and other stakeholders. Taken together these contribute to a broad set of drivers for board action on sustainability, including in response to

-

Investor expectations

-

Regulatory compliance and legal risk management

-

Customer demands

-

Employee attraction and retention

-

Civil society advocacy and public scrutiny

-

Business value protection and creation

-

Business resilience

These drivers have also propelled a wave of legal and regulatory action that affects companies and their boards. For example, the EU Corporate Sustainability Reporting Directive mandates extensive disclosures overseen by the board. Two new laws in California mandate corporate disclosure on climate emissions and related financial risk. According to a recent survey, “Nearly three-quarters (73%) of organizations say that ESG disputes will be a risk to them in 2024,” making it the “top litigation risk” in the study.

Consequently, boards of directors are recognizing the relevance of these topics to their long-standing duties and taking on more formal, direct, informed, and active oversight of how sustainability and ESG relate to corporate governance, strategy, and risk.

The 2022-2023 NACD Board Practices and Oversight Survey found that nearly 60 percent of public companies’ directors reported that their boards have increased the prioritization of ESG issues, and only 3 percent reported that their boards have decreased the prioritization of ESG issues.

As Ghita Alderman, Associate Director, ESG Content at NACD, explains: "Rooted in the traditional duties and role of the board, effective oversight of sustainability is now recognized as a fundamental part of good corporate governance, strategy, and risk management for all companies. That’s why we are seeing first-hand a surge in directors seeking more information and insight to bolster their ability to provide that effective oversight.”

Four Challenges for Boards

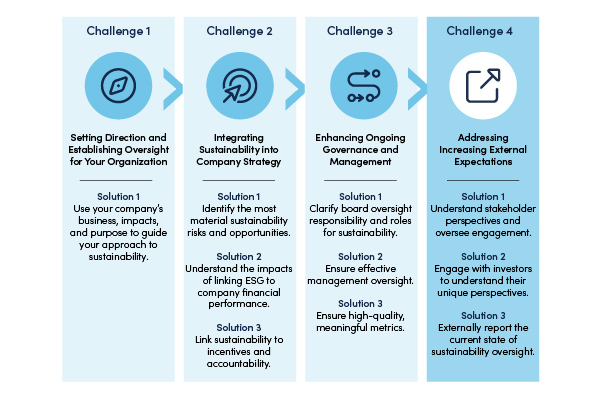

Oversight of Corporate Sustainability: A Board Primer examines four major challenges for boards to address and proposes a series of solutions and good practices for each.

-

Challenge 1: Setting Direction and Establishing Oversight for Your Organization

-

Challenge 2: Integrating Sustainability into Company Strategy

-

Challenge 3: Enhancing Ongoing Governance and Management

-

Challenge 4: Addressing Increasing External Expectation

In responding to these challenges, boards may encounter a range of sustainability issues. Individual companies benefit from understanding which topics are “material” to the company—relevant both to business success and to impacts on society and the environment. To that end, the report provides guidance on board oversight of the process to identify material issues, as well as on key topic areas ranging from understanding climate risk to the role of the board in overseeing human rights.

By grounding board oversight in the solutions proposed in the Primer and a focus on “material” topics, directors can promote a robust approach to corporate sustainability, thereby helping to fulfill their duties as directors, stewards of long-term value creation, and overseers of the company’s impacts on society and the environment.

NACD members may access the full report via NACD; BSR members may access the report via the BSR member portal or by contacting their Relationship Manager.

BSR’s latest sustainability insights and events straight to your inbox.

Topics

Let’s talk about how BSR can help you to transform your business and achieve your sustainability goals.